Embarking on an entrepreneurial journey is an opportunity to bring your visionary ideas to life and explore new horizons. However, amid the excitement lies a crucial reality: the business landscape is as much a terrain of possibilities as a pit of challenges. Navigating the path to long-term success involves understanding and mitigating risks.

Regardless of your industry, your business could face potential pitfalls⎯from market fluctuations and financial uncertainties to regulatory challenges and operational hiccups. In this comprehensive guide, you’ll learn how to identify and evaluate various business risks. By fostering a proactive approach to business risk management, you can safeguard your ventures and thrive despite uncertainty.

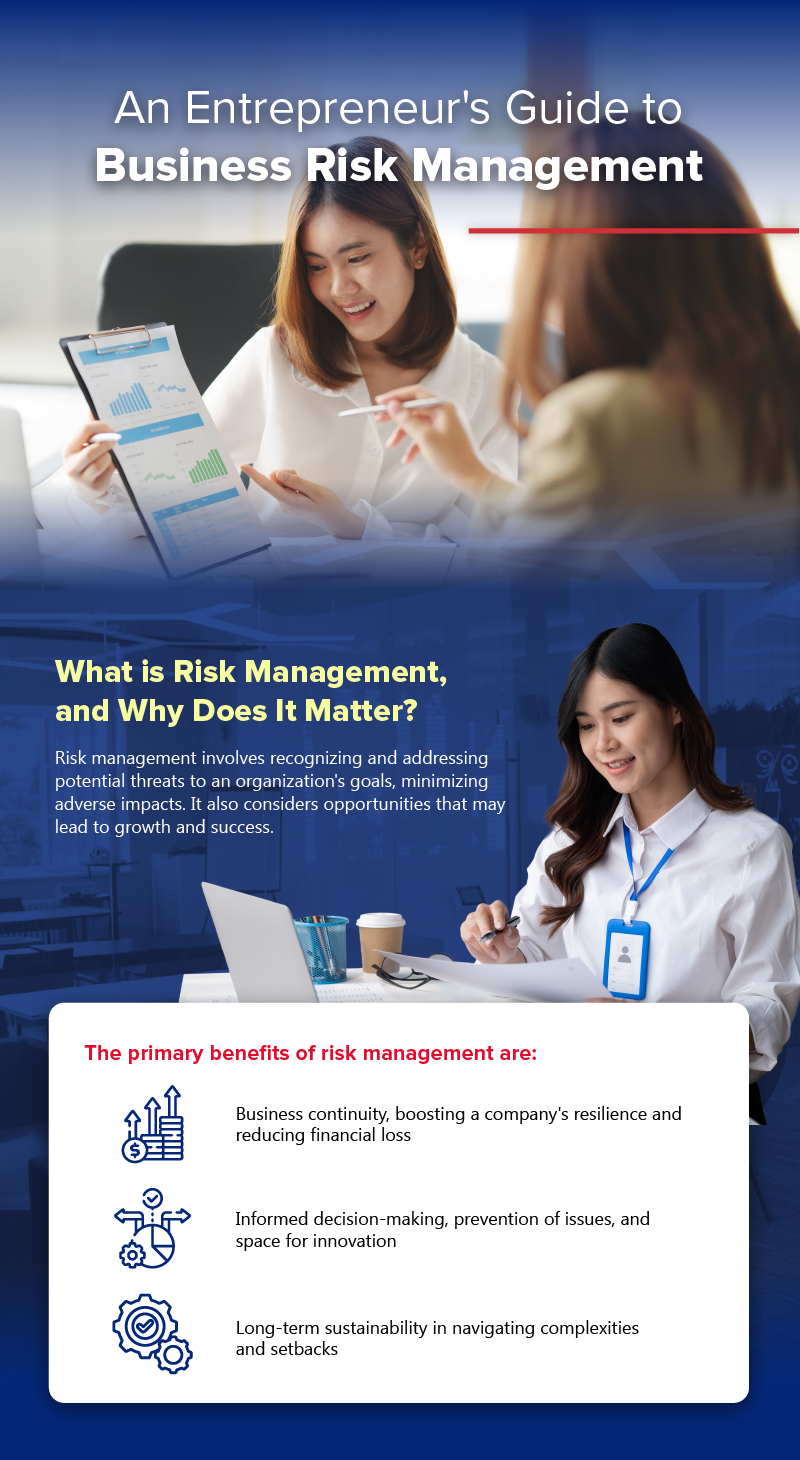

What is Risk Management?

Risk management involves identifying your company’s vulnerabilities and taking proactive measures to minimize their impact, which may hinder its objectives or goals.

Some risks come in disguise as something positive. For instance, expanding your business is an opportunity for growth and more achievements. You can franchise across the country to reach more customers and multiply sales. But if mismanaged, it can trigger several threats or cause a total crash.

The bottom line of risk management is to avoid or lessen potential challenges or adverse effects on your company.

Why is Risk Management Important?

Risk management positions your business to survive and thrive in a complex world. Effective risk management helps you anticipate and mitigate potential threats.

You can minimize disruptions and preserve business continuity that may result in financial loss. Addressing risks early prevents costly litigation, regulatory fines, operational downtime, and other expenses, too.

Properly handling risks also fosters smarter choices, which can help prevent issues while making room for innovation. For instance, identifying risks allows you to focus your resources on areas that bring growth and success.

Simply put, establishing risk management equips your company to endure challenges, recover from setbacks, and sustain its operations.

5 Main Types of Business Risks

The risks are generally similar whether you have a small or large enterprise. Here are some business threats you should keep an eye on:

1. Financial risk

Financial risks refer to potential threats that can lead to economic losses or negative impacts on your business’s financial health. These risks can arise from financial mismanagement and external factors like currency depreciations and market shifts. They can affect your company’s ability to generate revenue, manage costs, and maintain profitability.

2. Strategic risk

Strategic risks stem from inefficiencies in your company’s business model or general strategy. These can include decisions related to business expansion, innovation, market positioning, partnerships, and overall direction.

3. Operational risk

Operational risks come from your company’s day-to-day activities, processes, and systems. These risks relate to the internal functions and people contributing to delivering products or services and achieving business objectives. Operational risks include human errors, technical failures, supply chain disruptions, etc.

4. Reputational risk

Reputational risks are hypothetical blows on your company’s image, brand perception, and credibility. Here, organizational behavior and external events affect how customers, employees, and investors view you.

Because of the digital age’s capability to spread information quickly through online platforms, reputation management is crucial. Reputational risks can have far-reaching consequences, influencing customer loyalty, investor confidence, employee morale, and overall business success.

5. Hazard risk

Hazard risks are potential dangers from the inherent properties of a specific environment, activity, or situation. These risks stem from physical, chemical, biological, or other factors that may cause harm, injury, damage, or adverse effects to individuals, communities, or assets. Examples include natural calamities, explosions, fire, equipment malfunction, and exposure to toxic substances.

4 Steps to Effective Business Risk Management

Successful business risk management calls for a systematic approach. Below are the four critical steps to achieving it:

1. Identify

The first step is to identify and understand the various risks your business might face. You must examine internal and external factors that may hinder your company from achieving its goals.

Doing this with your team during a brainstorming session is best so you have more hands on deck. You can also engage with stakeholders in your organization to ensure a comprehensive understanding of potential risks. Document and categorize these risks to create a clear picture of the risk landscape.

2. Assess

After identifying the risks, the next step is to calculate them. Evaluate the severity of each risk and the probability of it occurring. This assessment helps you prioritize risks based on their possible consequences. Rank each risk based on impact and likelihood.

One way to do this is to create a risk heat map, which visually represents your company’s risk landscape. It lets you assign numerical values and a color-coded system to indicate the impact and likelihood of risk events and how the risks rank based on impact and probability.

3. Treat

One of the most challenging parts of the risk management process is determining your action to address the problem. There are several options you can adopt, depending on your situation:

- Acceptance – This approach applies to tolerable risks or those where the cost of mitigation outweighs the potential consequences. For instance, a software development company accepts the risk of minor software bugs that might not significantly affect user experience, as addressing these bugs requires extensive time and resources. This technique only requires monitoring.

- Mitigation– Alleviating or increasing a risk involves taking proactive measures to decrease the likelihood or impact of the event. You can apply this strategy when the potential negative outcomes are significant, and there are feasible ways to minimize them.

Take a construction company, for example. It may implement strict safety protocols and provide training to workers to mitigate the risk of accidents on construction sites.

- Transfer or sharing – When appropriate, assign a third party, like an insurer, to take responsibility or split a venture with a partner. Outsourcing is an effective way of transferring risk, especially if the service provider specializes in it. Meanwhile, two companies can share the financial risk of a large project, allowing them to pool resources and expertise.

- Avoidance or exploitation – In cases where the risk impact is high, you may need to eliminate the risk or take advantage of it. For instance, a pharmaceutical company may decide not to invest in a drug research project due to the high uncertainty and potential regulatory hurdles.

Conversely, a tech company may see a market opportunity in a growing industry and invest heavily in developing innovative products to gain a competitive advantage.

4. Monitor

Regular tracking is a must. Efficient business risk management doesn’t end, as existing risks can evolve and new threats might emerge. It’s best to continuously assess and review the effectiveness of your risk mitigation efforts, adjusting strategies as needed.

Risk Management Standards

Guidelines provide organizations with a structured approach to identifying and managing risks. They offer best practices and principles to help you systematically address challenges affecting your operations and success. Think of risk management standards as roadmaps that help you navigate the complex landscape of risks.

There are various risk management standards, including these two models:

ISO 31000

The International Organization for Standardization established ISO 31000, which is applicable globally. It provides risk management principles for businesses of all sizes and industries. Its approach focuses on an organization’s governance, strategy, and decision-making processes.

ISO 31000 has a comprehensive framework covering the entire risk management process⎯from risk identification and assessment to risk treatment, monitoring, review, communication, and consultation.

BS 31100

The British Standards Institution (BSI) developed BS 31100. While widely respected, it’s more suitable for UK and European businesses.

BS 31100 offers more detailed guidance on risk management principles, assessment methods, and treatment strategies. Furthermore, BS 31100 outlines particular roles and responsibilities for individuals involved in risk management, such as senior management, risk owners, and risk practitioners.

All Set with Business Risk Management

Entrepreneurship comes with challenges, but the journey is worthwhile when you see your hard work pay off. As you start your venture, it’s best to know the ropes, from compliance to various business risks and how to handle them effectively. Then, remember the four steps of the risk management process: identify, assess, treat, and monitor.

When it comes to financial assistance, Asialink Finance Corporation can help. We are a loaning company with the right tools to support your personal, auto, or business loan. Get fast and convenient loans today from Asialink.